CLUJ-NAPOCA MODERN OFFICE STOCK

CLUJ-NAPOCA MODERN OFFICE STOCK

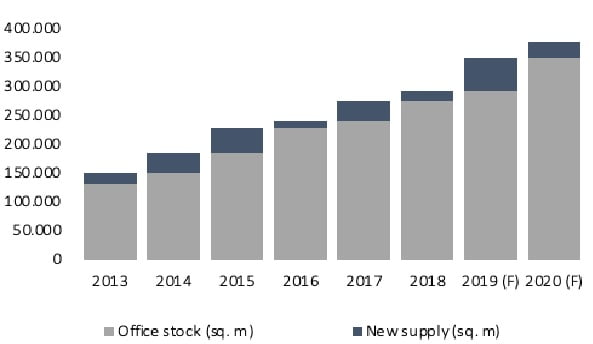

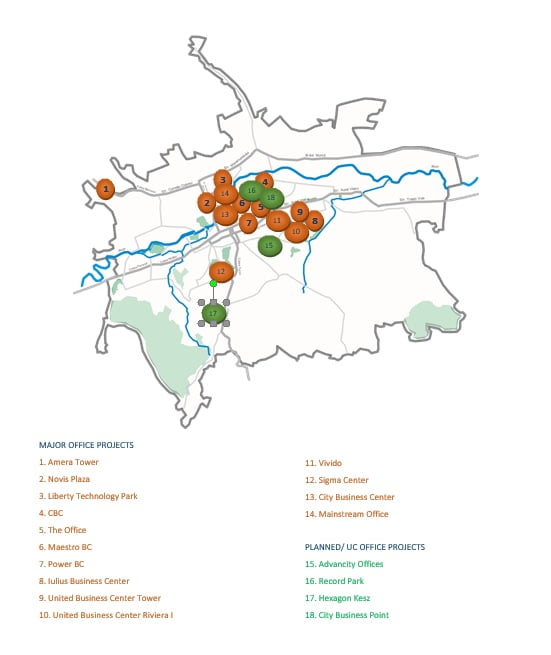

With a stock of over 315,000 square meters at the end of Q3 2021, Cluj-Napoca is the second most developed city in Romania, after Bucharest, in terms of the modern office stock. The largest office project in the city is The Office, with a leasable area of approximately 55,000 sqm, developed in several phases, starting in 2012.

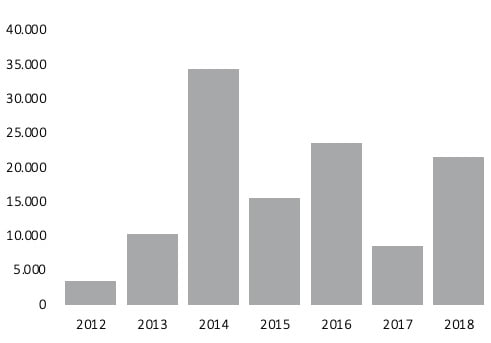

Between 2012 and 2018, approximately 100,000 sq. m of office space was completed in Cluj-Napoca. The largest volume was delivered in 2015 – 43,000 sq. m of modern office space, this being the highest volume registered for one of the regional cities in the country. Moreover, in the same year, the largest office building outside Bucharest – The Office, the second phase, with a leasable area of 19,400 sq m, was delivered in Cluj.

Throughout 2016, approximately 15,000 sq m of modern offices were delivered in Cluj-Napoca, with the majority of the completed buildings being of owner-occupier type.

2017 was again a record year in terms of new supply, among the four regional cities in the country with a modern office stock (Cluj-Napoca, Timisoara, Iasi and Brasov). A total volume of 43,000 sq. m of office space was finalized in the city.

2018 – over 11,000 sq. m were completed in Cluj-Napoca. The first phase of United Business Center Riviera was the largest project delivered, having a GLA of 8,500 sq. m. followed by one of the most iconic boutique office building in Cluj, Mainstream Offices.

For the 2019 – 2020 period, office projects with a total leasable area of approximately 90,000 sq. m are planned for delivery, a volume that might increase the total stock of offices by the end of 2018 by approximately 30%, compared to the existing stock at the end of Q1 2019.

Among the projects to be completed in the next period are the second and third phases of United Business Center – Riviera, developed by Iulius Group, Record Park – phase I or Hexagon, developed by Kesz Group.

MODERN OFFICE DEMAND

In the last years, Cluj-Napoca has been considered the most attractive city in Romania, after Bucharest, by companies in the field of Technology & Telecommunications, Business Process Outsourcing (BPO), financial or professional services. Due to the high number of students, competitive salaries and relatively low occupancy costs, the city was chosen as a business location by major companies such as Genpact, Endava, HP, Siemens, Bombardier, Intel or Accenture.

The demand for modern office space in Cluj-Napoca saw a record high in 2014, when about 35,000 sq m were transacted, representing the highest level outside Bucharest. In 2015, the total demand was equal to the net one, reaching 16,000 sq m. About 80% of the demand registered during the year was traded by IT companies.

In 2016, the demand for office space in Cluj-Napoca increased by 50% compared to the previous year, reaching 23,600 sqm. This consisted only of new demand, without further renegotiations. 2017 was quite a weak year in terms of demand, with a total volume transacted below the 10,000 sq. m threshold, ranking third among all four monitored regional cities, after Timisoara and Iasi. However, last year things shifted – approximately 22,000 sq. m were transacted, 80% from the total volume recorded being represented by new demand.

Starting from 2014, the general vacancy rate in Cluj-Napoca has been continuously decreasing, reaching approximately 5% at the end of Q1 2019. For class A office buildings, the vacancy rate is below the 3% threshold, while for class B buildings it is somewhere around 4%.

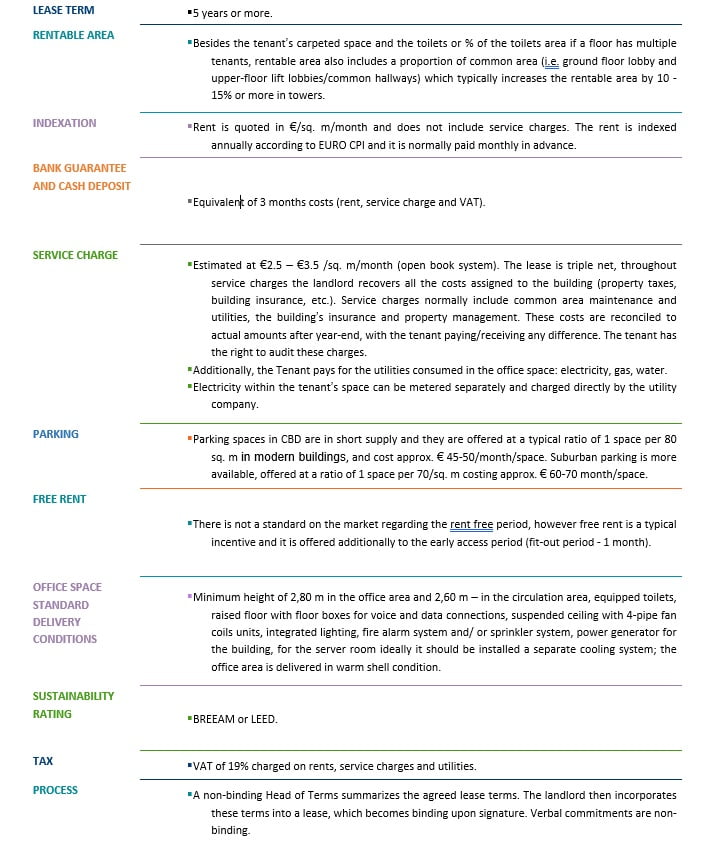

The headline rent for modern class A office spaces has remained constant over the past two years, ranging from 14 to 16 € / sq m / month. For class B buildings, the rent is around 8-11 € / sq m / month. Service costs vary between 2,5 and 3,5 € / sq m / month. The costs for office services are subject to triple net lease agreements. Through these fees, the owner recovers all the costs for the building. Service charges typically include maintenance of common areas and utilities, building and property management.

CONCLUSIONS & RECOMMENDATIONS

With a specialized workforce, a well-developed infrastructure and a significant touristic potential, Cluj-Napoca has been one of the most dynamic economies in Romania.

Furthermore, the city is the most developed office market in the country, after Bucharest, performing extremely well, both in terms of demand and supply and is expected to continue the same trend going forward. The modern office stock is experiencing a quite major development phase, with over 90,000 sq. m of space being planned to be completed in the following two years. Compared with other regional markets, Cluj-Napoca will remain the second most developed market in the country in terms of modern office stock, given the total stock might increase by approximately 30% by the end of 2020.

The market has witnessed significant activity, with an abundance of spaces being committed to prior to building delivery. In recent years, Cluj-Napoca has been considered the most attractive city in Romania, after Bucharest, by companies active in the Technology & Telecommunications sector, business process outsourcing (BPO), financial or professional services.

Due to the high number of students, competitive salaries and relatively low occupancy costs, the city was chosen as a business location by major companies.

Location has become a major factor when deciding towards a new office. Tenants are usually looking to find the perfect balance between location, good connectivity to the public means of transportation, space flexibility, workspace environment, and occupancy costs.

The most sought-after destinations in Cluj-Napoca by companies looking to expand or open new offices are the central areas, which, at the moment, have a vacancy rate close to 0. In the Central Business District (CBD) for example, potential tenants do not have many options to choose from.

Areas larger than 1,000 sq. m GLA cannot be secured without a pre-lease agreement, given there aren’t any spaces available. The ‘’fight to attract tenants’’ that occupy over 1,000 sq. m will mainly be between large office owners that can offer flexibility both in terms of space and location. Thus, taking into account the increasing demand and the low level of available spaces in the city and especially in the city center, developers are starting to build modern office projects on a speculative basis. Moreover, in order to attract clients, developers will improve the standard delivery conditions of the spaces and will try to increase efficiency. Analyzing the current pipeline in Cluj-Napoca, we see that boutique type office projects have gained ground, given they offer a more convenient location, high quality of finishes and amenities, as well as a distinctive architecture.

For 2019, we estimate that demand will grow slightly, with pre-leasing activity accounting for a significant portion of the total volume, due to the high number of projects under construction to be delivered – approximately 40% of the projects currently under construction have already been pre-leased. In 2020, demand for class A office space in Cluj-Napoca will remain constant.

In terms of occupancy costs for class A office space, Cluj-Napoca is a competitive market, with headline rents being around 14.5 EUR/sq. m/month. The market has been “tenant led” in the past few years and the situation is unlikely to change in the near future.